nj bait tax non resident

Regardless of pass-through entitys participation in the BAIT pass-through entities are still responsible to remit withholding tax on the non-resident owners NJ income. For S-corporations BAIT is calculated.

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

PL2019 c320 enacted the Pass-Through.

. The original BAIT law allowed residents and non-residents who receive New Jersey-sourced income from pass-through entities to pay the business alternative income tax. NJ source income from the K-1. NJ source income and non-NJ source income from the K-1.

New Jersey business owners may want to reconsider passing on the NJ BAIT election due to recent legislative change. 24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax. MarriedCU partner filing separate return.

For New Jersey residents electing the BAIT can be an especially viable workaround to the SALT limitation. Pass-Through Business Alternative Income Tax Act. Governor Murphy signed into law a bipartisan bill.

Effective for tax years beginning 2020 the New Jersey Business Alternative Income Tax BAIT is an elective entity-level tax on pass-through businesses. Pass-Through Business Alternative Income Tax Act. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the.

Regardless of its participation in the BAIT a firm organized as a PTE must continue to withhold tax on the non-resident owners New Jersey income. Residents are allowed a refundable credit against their New. BAIT is calculated for partnerships so that all income not just New Jersey-sourced income is subject to the tax if the owner is a New Jersey resident individual estate or trust.

NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax. Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a.

So on the federal side we have the 275000 of distributive proceeds. MarriedCU couple filing joint return Head of household Qualifying window ersurviving CU partner. The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT.

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Form Nj 1040nr Income Tax Nonresident Return Youtube

Nj Bait Year End Tax Planning Considerations For Pass Through Entities Wilkinguttenplan

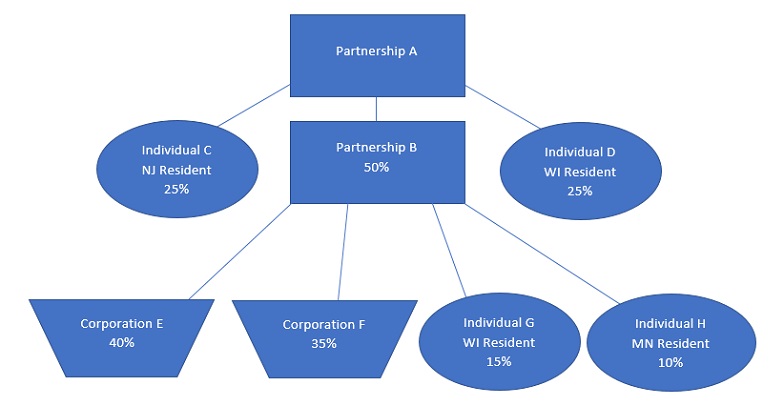

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

Governor Murphy S Nj Business Alternative Income Tax Bait Clean Up Bill Provides Additional Relief To Nj Passthrough Entities

What Is The Pass Through Business Alternative Income Tax Act

Nj Residents To Receive Millions From Intuit Turbotax Settlement Over Free Tax Filing Campaign Lakewood Alerts

Take The Bait Why Nj Business Owners Should Reconsider The Business Alternative Income Tax Withum

Nj Bait Developments News Levine Jacobs Co

Nj Division Of Taxation Nj 1040 And Nj 1041 E File Mandate Faq

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

Highlights Of The New York State Pass Through Entity Tax Prager Metis

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

![]()

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein